Cutler Commentary

CUTLER'S Q4 MARKET UPDATE

December 31, 2023

Market Commentary

Will 2024 be the year that everything finally feels “normal?” Stocks and bonds have been trying to escape the shadow of the pandemic, but lingering inflation has been a reminder of the lasting impacts of COVID-era policies….There are hopeful signs.

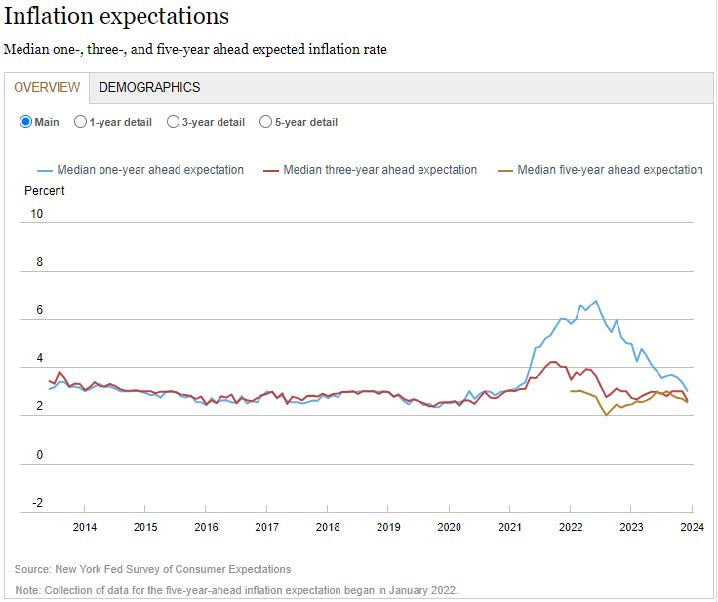

As we left 2023 behind, inflation, that lasting pandemic-era nuisance, was finally subsiding. Headline inflation, as measured by the CPI, sat at only 3.1% (Nov reading). This is just modestly above the Fed’s 2% target. Other inflation readings, such as the Fed’s preferred PCE (Personal Consumption Expenditures Price Index) came in even softer. Both stocks and bonds reacted positively in the Fourth Quarter to these tampered inflation expectations and the increasing possibility of Fed Funds rate cuts in 2024. By year-end the Federal Reserve was forecasting three rate cuts in 2024. The market expectations? Six rate cuts. With the economy estimated to grow in Q4 at 2.2% (Atlanta Fed GDPNow estimate as of 1/10/24), the possibility of rate cuts coupled with modest growth have many forecasters dreaming of a “soft landing.” It appears the worst of the inflation is behind us, as the nearby New York Fed data shows inflation expectations near their historical averages.

With lower inflation, lower rates, and strong growth, what could curtail this otherwise rosy picture for the economy? Why does the Conference Board’s Leading Economic Indicators continue to forecast a recession? Why has the yield curve been inverted, which is a traditional recession indicator, since July 5, 2022? The longest inversion since 1980! The answer to these questions remains elusive, but in our view the questions should not be ignored. As we enter 2024, we believe the equity bull market is not over. Most of the hard work fighting inflation is behind us. But these lingering questions impact our preferred market positioning. While equities should benefit from a lower rate environment, this is still an economy that contains risk. Ask any long-term Cutler client what types of investments we prefer to manage market risk- and the answer is likely to be “income.”

How do we believe investors should position themselves as we head into 2024? The economic backdrop continues to favor equities, primarily the continued expectation of modest economic growth. Lower interest rates may continue to pressure the dollar, and if so, could boost international equities relative to those in the US. Lower rates would also suggest that bonds should outperform cash. Since the yield curve inversion, money market funds have become a preferred investment vehicle. (Almost completely) risk-free and 5%+ yield? Where do I sign up!? But with the expectation of lower rates, we believe investors will benefit from their bond exposure, which tends to rally as the Fed cuts its discount rate.

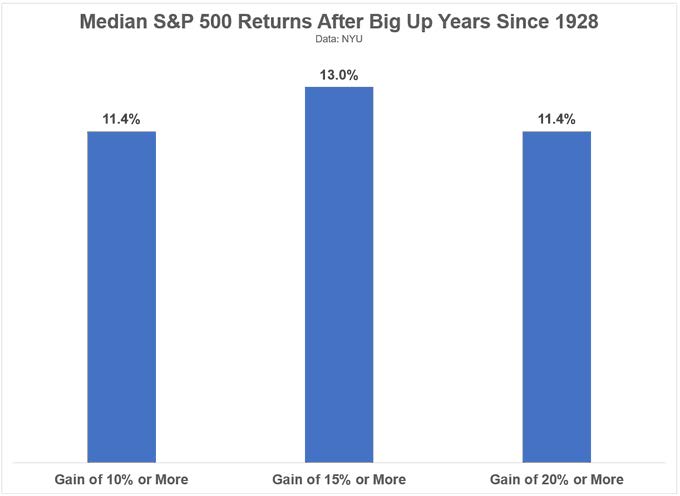

What about US stocks? After a banner year from growth stocks, we are anticipating broader market participation in 2024. Why? Two reasons: 1. Valuation; The S&P 500 is trading at 19.5x forward earnings estimates. However, if we equal weight the index, which reduces the large influence of the Magnificent 7 stocks (Apple, Alphabet, Amazon, Facebook, Microsoft, NVIDIA, Tesla), the S&P 500 trades at 16.4x. 2. Interest rates Value stocks, often higher yielding stocks, typically have a consistent dividend payout. This payout increases in relative value as rates drop and investors seek more income. The concentration of the S&P 500 has made that index particularly vulnerable to the performance of just a few companies. The Magnificent 7 had returns averaging 53% last year (but consider in 2022 we saw nearly the inverse of 2023’s results). Apple, at over 7% of the S&P 500 (with Microsoft just behind), has a greater weight in that index than any company in over 30 years! Investors might be left to wonder, “Can stocks rally a year after the S&P 500 returned over 25%?” Absolutely they can, but in our view, we would expect different leaders to emerge from an increasingly top-heavy stock market. The chart nearby shows that over 35% of the time stocks rally over 10% after a double digit increase the previous year. One take away from this chart? Market timing is hard, so stick to your strategy!

Asset Class Positioning

2023 was a banner year for pretty much all asset classes. That wasn’t the case for much of the year, but the monster Q4 rally generated returns in from investments other than the growth allocation in client portfolios. Large cap growth stocks (again, the Magnificent 7) were up a whopping 42% during the year. International stocks, which have been a laggard for much of the past decade returned a very respectable 18.85%. Mid-Caps and Small-Caps finished the year up about 16%, but most of that return came in the final quarter of the year. This further demonstrates the importance of the Fed’s interest rate outlook on current stock market sentiment. Bonds, after the Barclay’s Aggregate Index had the worst year in history in 2022 (-13%!), finished the year up 5.5%. The Agg was threatening to have an unprecedented 3rd consecutive negative year, but…yes, you guessed it- the softer inflation data unleashed a bond rally that looked like a champagne cork on New Year’s Eve.

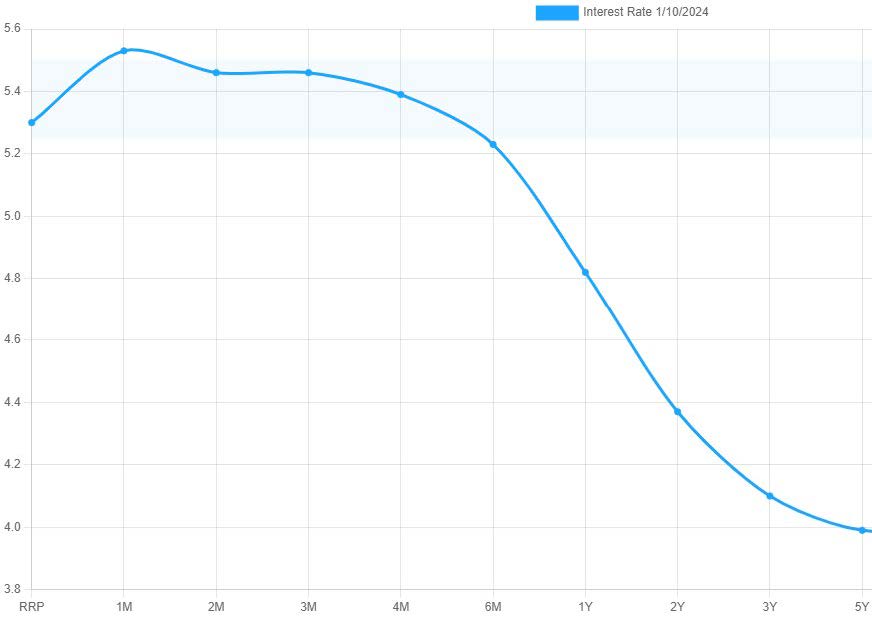

While the hard work of fighting inflation may be behind us, hard work for bond investors may be ahead. Short-term bonds (a nice proxy for money market rates) had a nice 4.89% return in 2023. However, the current yield curve shows how these rates look dampened for the next few years. The chart nearby shows the dilemma. Should today’s bond investors “lock in” the available rates while they can, or should they continue to own money market funds and hope the Fed lowers rates slowly? The answer, of course, is “it depends”- both on the time horizon for the investment, the risk appetite, and the benefits of locking in the cash flows currently available in the Treasury market. Our view is the while money market funds have been an attractive investment vehicle this past year, investors should think about a diversified portfolio with these idle assets. Historically, both stocks and bonds have had higher returns than cash, despite the temporary outperformance that cash can provide in bear markets.

Past performance is not indicative of future results. Strategies referenced herein may be materially different than actual positions held in client accounts. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be profitable or suitable for a particular investor's financial situation or risk tolerance. Investing involves risk, including loss of principal. You cannot invest directly in an index. Asset allocation and portfolio diversification cannot assure or guarantee better performance and cannot eliminate the risk of investment losses. Neither Cutler Investment Counsel, LLC nor its information providers are responsible for any damages or losses arising from any use of this information.

The S&P 500 Index is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization.

The Barclay’s Aggregate Bond Index (Taxable Bond) is a broad base, market capitalization weighted bond market index representing intermediate term investment grade bonds traded in the United States.

Headline Inflation is the raw inflation figure reported through the Consumer Price Index (CPI) released monthly by the Bureau of Labor Statistics. The Bloomberg Commodity Index (Commodities) is an index of the prices of items such as wheat, corn, soybeans, coffee, sugar, cocoa, hogs, cotton, cattle, oil, natural gas, aluminum, copper, lead, nickel, zinc, gold and silver. The index is calculated on an excess return basis and reflects commodity futures price movements.

The MSCI EAFE Index (Foreign Developed Index) is designed to represent the performance of large and mid-cap securities across 21 developed markets, including countries in Europe, Australasia and the Far East, excluding the U.S. and Canada.

The MSCI Emerging Markets Index captures large and mid-cap representation across 27 Emerging Markets (EM) countries. With 1,392 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. Bitcoin Each crypto index is made up of a selection of cryptocurrencies, grouped together and weighted by market capitalization (market cap). The market cap of a cryptocurrency is calculated by multiplying the number of units of a specific coin by its current market value against the US dollar.

Source: Morningstar All opinions and data included in this commentary are as of January 10, 2024 and are subject to change. The opinions and views expressed herein are of Cutler Investment Counsel, LLC and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This report is provided for informational purposes only and should not be considered a recommendation or solicitation to purchase securities. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed.

Source: ustreasuryyieldcurve.com

CATEGORIES

Disclaimer

These blogs are provided for informational purposes only and represent Cutler Investment Group’s (“Cutler”) views as of the date of posting. Such views are subject to change at any point without notice. The information in the blogs should not be considered investment advice or a recommendation to buy or sell any types of securities. Some of the information provided has been obtained from third party sources believed to be reliable but such information is not guaranteed. Cutler has not taken into account the investment objectives, financial situation or particular needs of any individual investor. There is a risk of loss from an investment in securities, including the risk of loss of principal. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor's financial situation or risk tolerance. Any forward looking statements or forecasts are based on assumptions and actual results are expected to vary. No reliance should be placed on, and no guarantee should be assumed from, any such statements or forecasts when making any investment decision.