Cutler Commentary

Market and Equity Income Commentary 2Q 2019

July 01, 2019

Cutler Investment Group Second Quarter 2019 Review

Market Commentary

Market Commentary

After a rocket shot upwards to start the year, markets experienced further gains during the second quarter; but they tested investor resolve in order to achieve them.

The double-digit gains in the first quarter left many investors wondering, “What’s next?” What was next was a bit of a rollercoaster as the second quarter started strong in April, then the wheels seemed to be coming off in May, before a strong rally in June based largely on the heels of commentary from Fed Chair Jerome Powell of an interest rate decrease. June is usually a terrible month for stocks (hence the cliché “sell in May and go away”), so this rally provided one of the best June return periods in modern market history and stocks finished the quarter right at all-time highs.

The primary drivers for both upside and downside continue to be speculation about the tariff/trade war situation and about possible actions by the Fed (and other Central banks to a lesser degree). The Fed continues to be keenly aware of market reaction to both their actions and their words, and has maintained the more patient dovish tone that Chairman Powell illustrated in Q1 following the Christmas Eve meltdown. The near-term reaction to this dovish tone is to be bullish, as this can make stocks look even more attractive, but as noted previously, this is built on a foundation of projected slowing global growth, which is hardly a bullish sign. The result was a quarter which experienced a unique phenomenon where both stocks and bonds were rallying at the same time.

We have noted some key data points in recent market commentaries. Those same data points seem to indicate that stocks are not necessarily overheated, but much of the recent gains are based on an interest rate move to the downside. Here is where those factors stand after the second quarter:

- Valuations. Valuations have risen as stocks continue to rally, with the S&P 500 settling between 16.5x and 17x earnings (Source: JPMorgan). This is fairly high, but not stretched, particularly if rates do cut.

- Economic growth. GDP was estimated at 3.2% for the first quarter (source: BEA), well above broad expectations. However, the impact of trade war and tariffs is expected to finally show on Q2 results and estimates for this quarter are largely in the 1-2% range. Opinion is also widespread on how long this impact will linger, even if the trade issues are resolved.

- Interest rates. The Federal Open Markets Committee maintained the short-term lending rate at 2.5%. The broad assumption is a rate cut will happen in July, spurred by low inflationary pressures and some global growth concerns. Actual 10-year yields and the S&P 500 yield are essentially identical now at 2.0% each.

- Currency. Currency impact this year has been mostly benign, with little boost or drag from converting local currencies to USD when factoring returns. However, the growing expectation for at least one rate cut has begun to weaken the dollar, a trend which could continue.

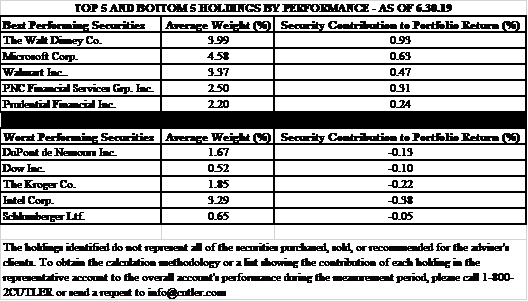

Cutler’s Equity Income strategy (5.01% gross, 4.86% net) outperformed both the S&P 500 TR (4.3%) and the Russell 1000 Value TR (3.84%) indices during the quarter. This strong performance was led by Disney, which had a return of 25.77% in the 2nd Quarter alone. Disney, through several years of strategic acquisitions, has built a dominant media company. In our view, their proposed streaming service represents a formidable counter to Netflix’s streaming service, and we feel the valuation today remains reasonable for long-term investors. Microsoft, which was up 14% in the quarter, was also worth noting as a large holding in the portfolio. Interestingly, both PNC Financial Services and Prudential were up over double-digits. Given the shift in the Fed’s rhetoric toward a more dovish view and the flattening yield curve, we would anticipate financials performance to be lagging. We continue to like this sector as the Fed works to normalize the yield curve going forward.

On the negative side, the DowDupont break-up has not yet unlocked significant shareholder value. The company has now split into three separate entities: Corteva (up 9.64% in Q2), DuPont (down 15.46% in Q2) and Dow (down 11.82%). We are continuing to review the investment thesis of each of these companies in order to determine their long-term role in the portfolio.

We are pleased with the lower interest rate environment, which could continue to be a tailwind for dividend paying equities. With the S&P 500 and the 10-year treasury now producing similar income, the argument to own dividend paying equities with a long-term horizon is even more compelling.

Past performance is not indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be profitable or suitable for a particular investor's financial situation or risk tolerance. You cannot invest directly in an index. Asset allocation and portfolio diversification cannot assure or guarantee better performance and cannot eliminate the risk of investment losses. Source: Morningstar

All opinions and data included in this commentary are as of July 1, 2019 and are subject to change. The opinions and views expressed herein are of Cutler Investment Counsel, LLC and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This report is provided for informational purposes only and should not be considered a recommendation or solicitation to purchase securities. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither Cutler Investment Counsel, LLC nor its information providers are responsible for any damages or losses arising from any use of this information.

CATEGORIES

Disclaimer

These blogs are provided for informational purposes only and represent Cutler Investment Group’s (“Cutler”) views as of the date of posting. Such views are subject to change at any point without notice. The information in the blogs should not be considered investment advice or a recommendation to buy or sell any types of securities. Some of the information provided has been obtained from third party sources believed to be reliable but such information is not guaranteed. Cutler has not taken into account the investment objectives, financial situation or particular needs of any individual investor. There is a risk of loss from an investment in securities, including the risk of loss of principal. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor's financial situation or risk tolerance. Any forward looking statements or forecasts are based on assumptions and actual results are expected to vary. No reliance should be placed on, and no guarantee should be assumed from, any such statements or forecasts when making any investment decision.